The Reserve Bank of India will announce its fourth bi-monthly monetary policy for the year on Oct 4,2016. This policy review shall be the first one for the incoming Guv Urjit Patel and the newly formed Monetary Policy Committee . Will it be a rate cut, a status quo or a rate hike in anticipation to the current economic and global conditions? Let us take a glimpse at the domestic conditions and the global economic conditions as well to assess the probable outcome of the monetary policy on the coming Tuesday. We will discuss the current scheme of things with the monetary policy, various domestic parameters, monetary policy transmissions – improvements and finally what would be the outcome of the monetary policy this time. It would be interesting to see if Dr. Patel would do a Rajan 2.0.

This review shall be a special one as the outlook shall be decided by a committee formed collaboratively by the RBI and the Government. The MPC aims to provide greater transparency to monetary policy while taking the onus of interest rate decisions away from the sole purview of the RBI governor. The committee comprises of 3 representatives from the Government (who are typically veteran economists) and 3 members from the RBI including the Governor. However, the chairman of the committee shall be the Guv himself but the overall decision making of the policy rates shall be taken as a committee decision.

The current scenario of the policy rates is as follows:

- Repo Rate – 6.5%

- Reverse Repo – 6% (Being pegged at 50 bps to the repo rate from the last policy review since the volatility of the call rates has significantly reduced)

- Marginal Standing Facility – 7.00 % (Being pegged at 50 bps to the repo rate from the last policy review since the volatility of the call rates has significantly reduced)

On the global front, most central banks have maintained their status quo although a few of them have reduced the deposit rates in order to reduce the cost of funding. The Federal Reserves stays put to their stance of status quo and is not expected to step on the gas until further significant recovery signals. On the domestic front, the CPI inflation rate has inched up significantly for the past two months leading to a higher average for the period. Food inflation, being one of the critical pain points for the Indian economy, has softened significantly due to near normal rainfalls and supply side management from the Govt’s end. The collaborative effort has fairly allowed the food inflation to be tamed at comfort levels. Let us take a quick view at all the other domestic and global factors to be considered for the monetary policy review.

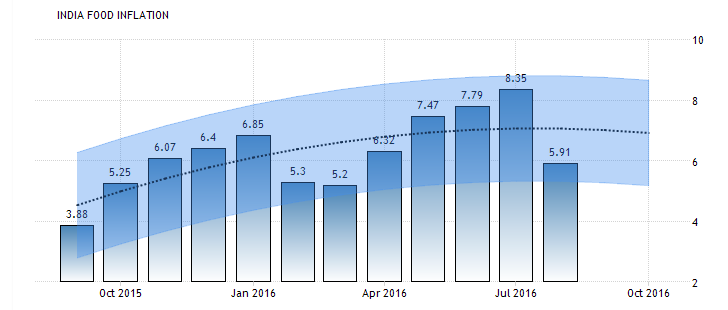

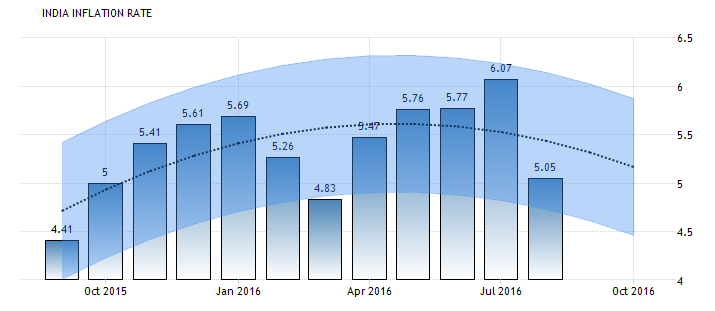

Headline inflation rate (CPI), has stepped southwards and is expected to be at the levels of around 5 % in the near future because of the steady and near normal rainfall this year. The sustainability of the rates staying in the desired corridor depends on an efficient supply side management from the Govt. This year, the rainfall deficit has only been 3% compared to the normal rainfall levels. The 91 important reservoirs of the country, which have efficient irrigating abilities are 97% of their maximum capacity, essentially suggesting that if used appropriately might turn out to be a game changer for the produce this year, thus reducing the overall food inflation. The food inflation , on the other hand, has dropped noticeably at 6 % levels from about 9% levels. Thanks to the fairly efficient supply side management. Below is the overall CPI inflation rates and food inflation rates:

The food inflation as well as the CPI inflation look quite stable and at comfortable levels and are expected to head southwards in the near future as well. But, with the festive season coming, the inflation might inch northwards sharply despite the ample supply. This might create a hindrance for a rate cut case. With the auto-regressive integrated moving average predicted forward curve shows a probable uptick in the inflation rates as shown below. RBI would want to wait and watch for the inflation numbers to be published in the next cycle before they create a case for a rate cut.

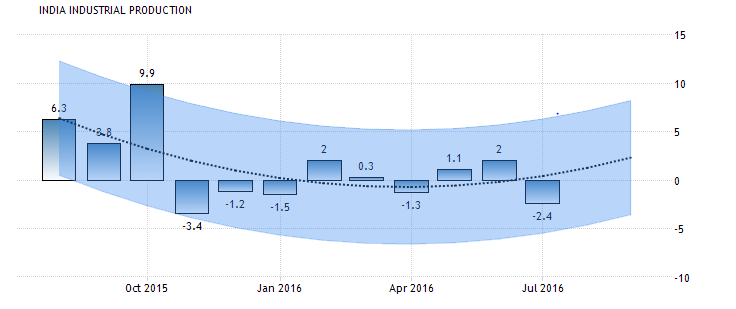

On the growth rate front, the IIP index has been in the negative areas for the past 2 months. However, the core growth metrics suggested otherwise for the current cycle. The core growth consists of growth rates of 8 prominent industries which contribute to about 38% of the IIP rates. The core growth rate has been significantly good at 3.2% which might help the IIP to be at a higher level. Although, the growth rates look dampened, they are expected to inch upwards due to higher demand and stable inflation rates. Here is the IIP trend so far and expectations:

In the case of IIP as well, the RBI would like to wait until there is another expectation of an IIP % drop.

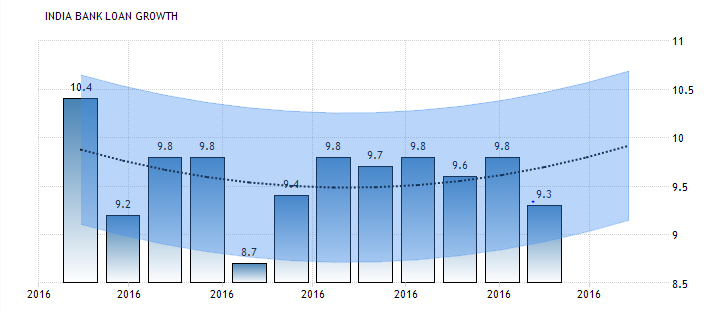

The banking sector has been facing turmoil because of the rising NPA’s and reduction in the overall increase in the exposures. The public sector banks have seen a sluggish credit growth of 9.26% whereas the private sector banks are clocking a fairly good credit growth rate of 20%. This trend is not new for India although, the public sector lenders have been defensive lately due to increasing bad loans. However, RBI might take some new actions in terms of forcing the public sector lenders to create sophisticated systems in order to perform an efficient credit and risk management and simultaneously clean up the balance sheets. RBI might not choose to use the repo rate route as of now since this is clearly a situation of fear regarding the rising bad loans more than the sluggish demand.

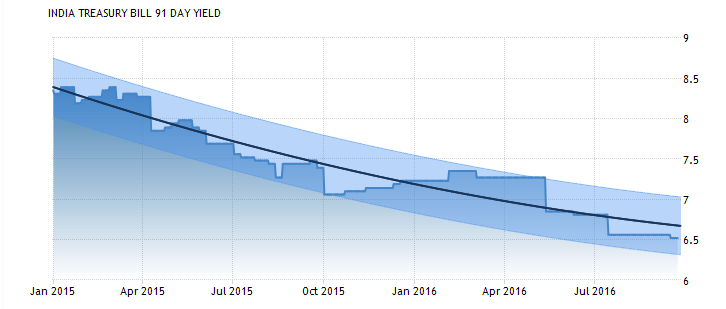

The call money rates/IBLR has been stable lately due to the efficient liquidity management by the RBI. The call rates are however expected to head downwards although at a decreasing rate since there is enough liquidity in the system in order to sustain sudden spikes. Here’s a quick view on how the rates have been so far:

Considering the average CPI at 6% and the repo rates at 6.5%, ERI is hovering around 0.25-0.5% which might affect the growth in the coming future. Although the ERI is much lower than the RBI comfort zone of 1-1.5%, this might not act as a trigger for a rate cut since taming inflation shall hold priority. However, it does call for a rate cut in December to increase that ERI window to 1% at least. We might expect some action from RBI in December, probably of about 50 bps rate cut.

What does all of this mean for the upcoming monetary policy?

With the average inflation almost close to the uncomforting levels of 6%, sluggish demand and higher industrial growth, RBI and the MPC would want to wait for more data in terms of the inflation trends in the near future. However, certain structural reforms in order to help banks clean up their NPA loaded balance sheets can be expected. I predict, that the RBI might hold the repo rates at the current levels of 6.5%. CRR and SLR might also be untouched due to the ample amount of liquidity and money supply in the system. But witnessing the current conditions and the forecast, RBI might have to step on the gas in the next review with a rate cut of 25-50 bps in order to ensure that the economy is at a comfortable ERI of 1% at least. However, the tone of the policy would continue to be fairly dovish, reform-driven and a certain push towards a more efficient monetary policy transformation. Also, RBI would want to maintain its accommodative stance and be clear in its long-term focus of creating the credibility that Dr. Rajan has started with. I hope with Dr. Patel’s stance, we might get to see Rajan 2.0.

Thank you. 🙂